Housing in Black America

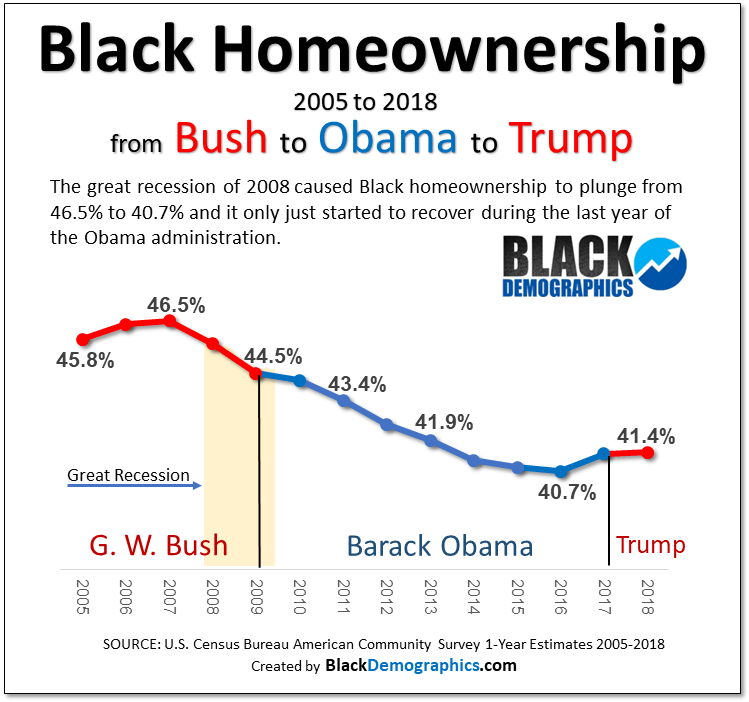

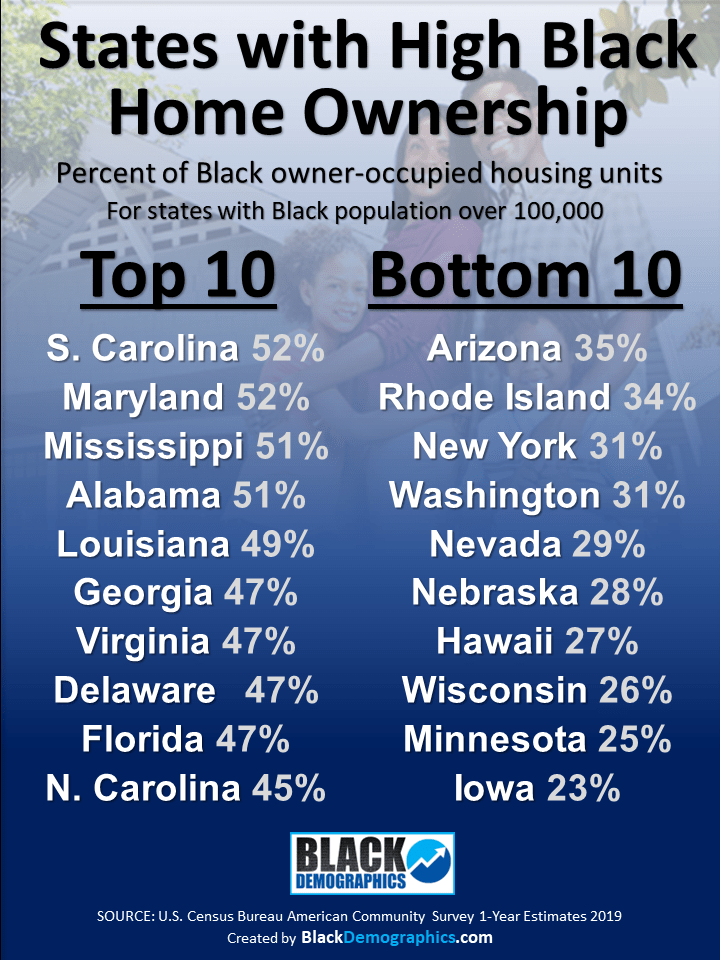

Many working-class Black Americans continue to face challenges in obtaining affordable housing. Black homeownership decreased between 2005 and 2017 from 46% to 41.4% While there have been some positive changes since 2017, the struggle remains significant.

Much of the losses can be attributed to the housing crisis, during which many Americans lost their homes to foreclosure. Unfortunately, the Black population has been the last to see an upward trend in homeownership. This also means, more than half of all African Americans continue to rent their homes.

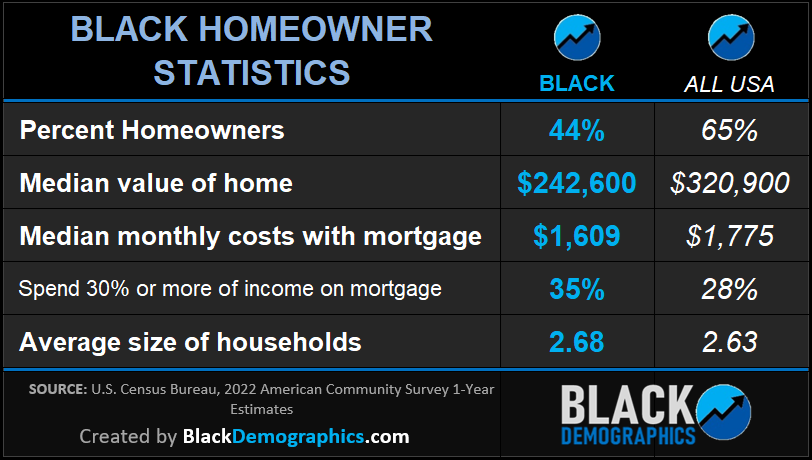

Homeownership

The percentage of Black homeowners increased slightly from 41.4% in 2017 to 44% in 2022. However, this still lags significantly behind the national average of 65% in 2022. This modest increase in homeownership among Black Americans may reflect some recovery from the housing crisis, but it is clear that more than half of all African Americans still rent their homes.

- Percent of Black Homeowners: 44% vs. (65% All USA)

- Decreased from 46% in 2005.

- Decreased from 46% in 2005.

- Median Value of Black Homes: $242,600 vs. ($320,900 All USA)

- Increased from $122,200 in 2012 to $153,500 in 2017.

- Increased from $122,200 in 2012 to $153,500 in 2017.

- Median Monthly Costs with Mortgage for Black Homeowners: $1,609 vs. ($1,775 All USA)

- Increased from $1,360 in 2017.

- Increased from $1,360 in 2017.

- Percent of Black Homeowners Spending 30% or More of Income on Mortgage: 35% vs. (28% All USA)

- Increased from 40% in 2005 to 43.9% in 2012, then decreased to 35.9% in 2017.

- Increased from 40% in 2005 to 43.9% in 2012, then decreased to 35.9% in 2017.

- Financial experts recommend that people should spend no more than 30% of their gross income on housing.

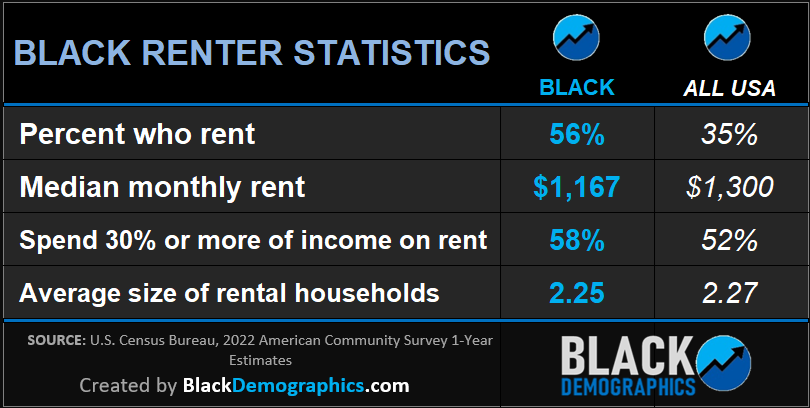

Rental Housing

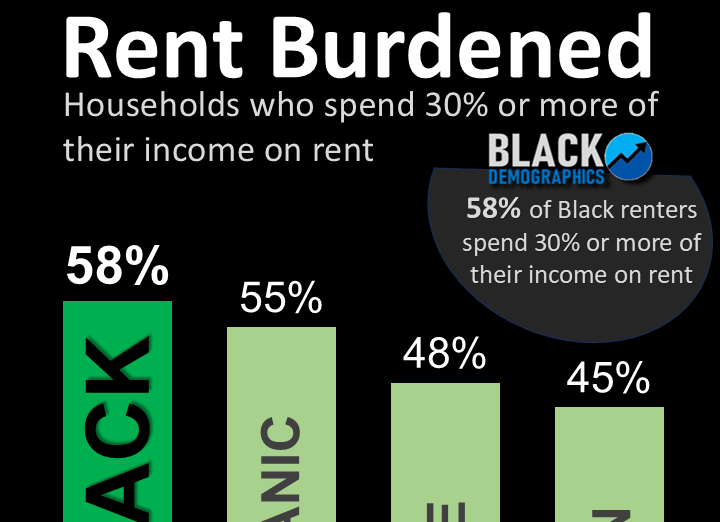

The percentage of Black renters remains high, with 56% renting their homes in 2022 compared to 35% of the total US population. The median monthly rent for Black Americans increased to $1,167 in 2022, up from $920 in 2017. Furthermore, 58% of Black renters spend 30% or more of their income on rent, indicating a high rent burden that makes it difficult for many to make ends meet.

- Percent of Black Renters: 56% vs. (35% All USA)

- Median Monthly Rent for Black Renters: $1,167 vs. ($1,300 All USA)

- Increased from $820 in 2012 to $920 in 2017.

- Percent of Black Renters Spending 30% or More of Income on Rent: 58% vs. (52% All USA)

- Increased from 53% in 2005 to 59.2% in 2012, then decreased to 56.3% in 2017.

- Financial experts recommend that people should spend no more than 30% of their gross income on housing.

- Average Size of Rental Households: 2.25 vs. (2.27 All USA)

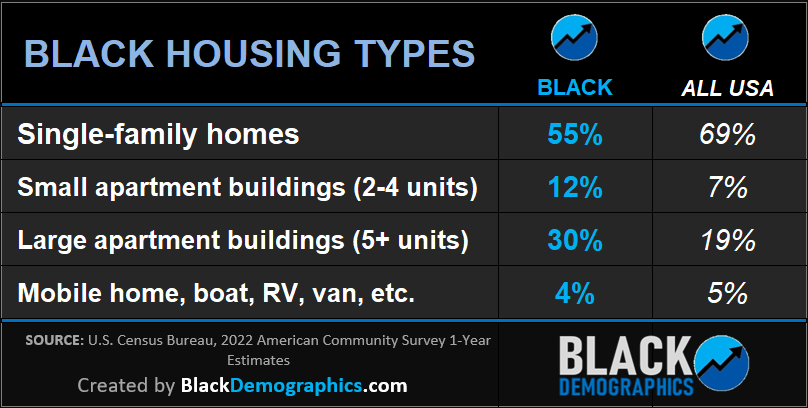

Housing Types

Black Americans are less likely to live in single-family homes compared to the national average. In 2022, 55% of Black housing units were single-family homes, compared to 69% for the entire USA. A significant portion, 30%, lived in large apartment buildings (5+ units), much higher than the national average of 19%.

- Single-Family Homes: 55% vs. (69% All USA)

- Small Apartment Buildings (2-4 Units): 12% vs. (7% All USA)

- Large Apartment Buildings (5+ Units): 30% vs. (19% All USA)

- Mobile Home, Boat, RV, Van, etc.: 4% vs. (5% All USA)

Conclusion

While there have been some improvements since 2017, significant disparities remain in housing conditions for Black Americans compared to the national averages. The increased costs of both homeownership and renting continue to place a substantial burden on Black households, affecting their financial stability and quality of life. Financial experts recommend that people should spend no more than 30% of their gross income on housing, yet many Black Americans exceed this threshold, underscoring the critical need for affordable housing solutions.

CLICK TO ENLARGE

CLICK IMAGE TO ZOOM

HOUSING ARTICLES

Earn Less – Pay More: The Housing Burden on Black Households

The Real Estate Reality: Black and White Homeownership and Rental Differences