Data from the U.S. Census Bureau’s American Community Survey shows that Black households spend a larger portion of their income on housing compared to White households, even though they earn significantly less. This financial imbalance highlights the challenges many Black households face in accessing affordable housing and achieving economic stability.

Housing Costs: A Heavy Burden

Black households are often disproportionately affected by high housing costs:

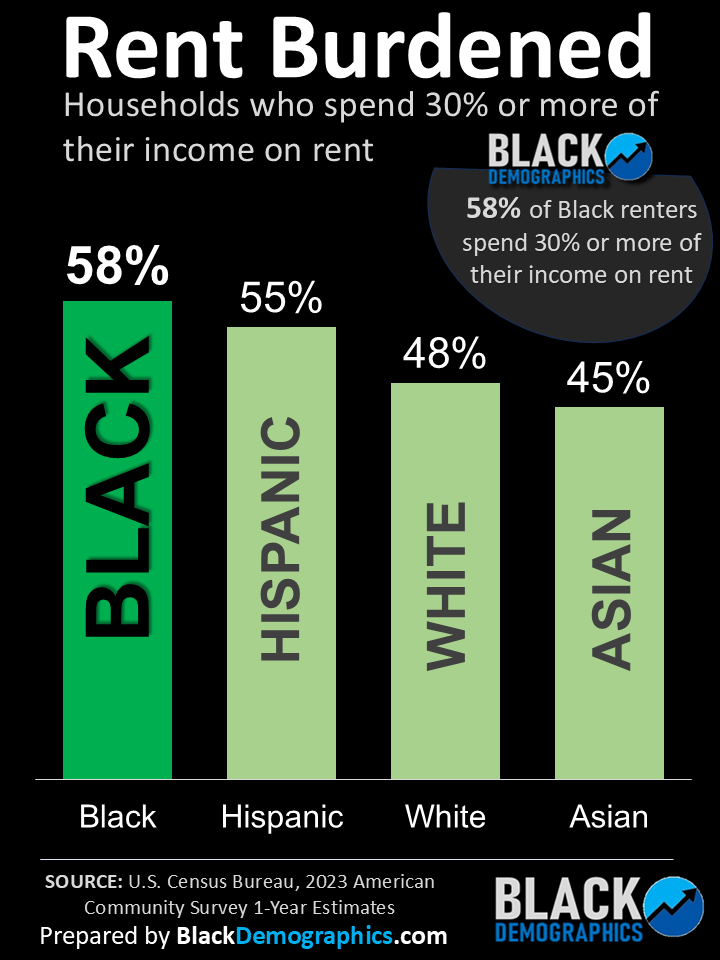

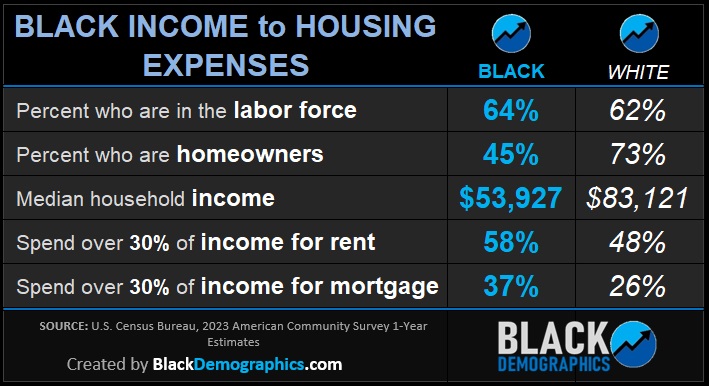

- 58% of Black renters spend over 30% of their income on rent, compared to 48% of White renters.

- 37% of Black homeowners with a mortgage spend over 30% of their income on housing, compared to just 26% of White homeowners.

Spending over 30% of income on housing is widely regarded as a financial strain that limits a household’s ability to cover other essential expenses like healthcare, childcare, or saving for retirement.

Labor Force and Homeownership Gaps

Although 64% of Black adults are in the labor force, slightly higher than the 62% of Whites, only 45% of Black households own their homes compared to 73% of White households. This lower rate of homeownership is a key factor in the overall wealth gap.

Homeownership is one of the most significant ways households build wealth in the United States. Owning a home allows individuals to benefit from property appreciation, build financial equity, and access opportunities to borrow against home values for education, business investments, or emergencies. Renters, by contrast, are unable to access these financial benefits, limiting their ability to build generational wealth.

For Black households, barriers to homeownership—such as high housing costs, limited access to credit, and rising interest rates—contribute to a cycle where renters find it difficult to transition into homeownership. Without the wealth-building advantages that homeownership provides, many Black households remain at a financial disadvantage compared to White households who benefit from decades of home equity growth.

Income Gap

The median household income for Black families is $53,927—nearly $30,000 less than the $83,121 median for White households. This income gap leaves Black households with fewer resources to cover housing costs, save for emergencies, or invest in building wealth.

Coupled with lower homeownership rates, this reality means that the majority of Black households—who are renters—lose more of their income to higher housing costs, leaving them with fewer financial tools to offset these challenges.

Challenges

The homeownership gap among Black households is more than just a housing issue. It directly impacts their ability to build and transfer wealth across generations. However, targeted initiatives, advocacy and resources are creating more opportunities for Black households to achieve homeownership and long-term financial stability.

Solutions?

A great resource for learning about financial literacy, particularly when it comes to credit for homeownership, is NeighborWorks America. This nonprofit organization specializes in housing education and financial counseling. It offers tools, workshops, and programs designed to help individuals build credit, save for a down payment, and understand the home-buying process.

Specific Initiatives Addressing Housing Challenges

Several initiatives and individuals are working to address the housing cost burden faced by Black families:

- The Center for Responsible Lending (CRL): CRL advocates for fair lending practices and affordable homeownership opportunities. The organization works to combat predatory lending and expand access to affordable mortgages, particularly for Black and low-income families.

- Enterprise Community Partners: This nonprofit works on creating affordable housing solutions nationwide, emphasizing access to housing as a tool for economic mobility. They collaborate with policymakers, developers, and local governments to increase the supply of affordable homes in urban and rural areas.

Here are a few other excellent resources. By leveraging these tools and programs, you’ll be better equipped to manage credit and make informed decisions on the path to homeownership.:

Here are a few other excellent resources. By leveraging these tools and programs, you’ll be better equipped to manage credit and make informed decisions on the path to homeownership.:

1. MyFICO

- This is the official consumer website for FICO, the company that creates the credit scores used by most lenders. MyFICO provides detailed explanations about how credit scores are calculated, tips to improve credit, and resources to prepare for mortgage applications.

2. HUD-Approved Housing Counselors

- The U.S. Department of Housing and Urban Development (HUD) offers free or low-cost housing counseling services. These certified counselors help individuals understand credit requirements for homeownership, create budgets, and prepare for buying a home.

3. CFPB (Consumer Financial Protection Bureau)

- The CFPB offers detailed guides and tools on topics like building credit, managing debt, and preparing for homeownership. Their resources are straightforward and easy to follow.

4. NACA (Neighborhood Assistance Corporation of America)

- NACA is a nationwide nonprofit that provides financial counseling and offers mortgage programs with no down payment or closing costs. They also help individuals improve their credit to qualify for a home loan.

5. Freddie Mac CreditSmart®

- This free educational program is designed to teach financial literacy and prepare individuals for homeownership. It covers credit-building strategies, debt management, and navigating the mortgage process.

6. Your Local Credit Union or Bank

- Many credit unions and banks offer free financial literacy workshops, tools, and one-on-one counseling to help potential homeowners understand credit requirements and improve their financial health.

7. Books and Online Courses

- Books:

- “The Total Money Makeover” by Dave Ramsey (for general financial literacy).

- “The Credit Repair Handbook” by Amy Loftsgordon (focused on improving credit).

- Online Courses:

8. Local Nonprofits or Community Development Corporations (CDCs)

- Many local organizations provide free financial literacy workshops focused on preparing individuals for homeownership. A quick search for “homeownership workshops near me” or reaching out to a local CDC can connect you to valuable resources.

By leveraging these tools and programs, you’ll be better equipped to manage credit and make informed decisions on the path to homeownership.

For more insights into the socioeconomic realities of Black communities, visit BlackDemographics.com.